My last post talked about how Kelsey Group’s proprietary software, Precise Pricing, can help an agent & seller price a home listing.

I also use this same software to assist buyers that are trying to decide if the home that they are considering is a good investment. Most buyers don’t want to just buy a home because it is a good financial investment, but it is an important piece of the puzzle that shouldn’t be ignored.

Last weekend, I spent two days looking at homes with a couple that is relocating to the St. Louis area. After looking at a number of homes throughout Chesterfield and Ballwin on our first day, they identified 2 homes that they liked. The homes were in different subdivisions, but they had the exact same floor plan. One home was 31 years old & the other was 40 years old, but they both had been completely updated by rehabbers.

Last weekend, I spent two days looking at homes with a couple that is relocating to the St. Louis area. After looking at a number of homes throughout Chesterfield and Ballwin on our first day, they identified 2 homes that they liked. The homes were in different subdivisions, but they had the exact same floor plan. One home was 31 years old & the other was 40 years old, but they both had been completely updated by rehabbers.

The two rehabbers had made slightly different choices. One had opened up the wall completely between the family room and breakfast room/kitchen. The second left a half wall in the same spot. There were a few other differences between the homes which left my clients struggling when trying to decide which home they liked better.

Ballwin Home:

~ Better yard with a relatively flat area plus it backs to dense woods (the other house has a steep drop-off and backs to dense woods so no yard for dogs or play sets)

~ Kitchen has a half-wall separating the family room and kitchen/breakfast room which gives the open floor plan feel but still helps define the separate rooms (compared to the wall completely removed in the other house)

~ Main floor laundry room off the breakfast room with a door that leads to the garage (the other house has a basement laundry and the garage door is through the family room)

~ High days on market means that the sellers may be willing to negotiate a lower price (compared to the other home which had been on the market for only 10 days)

Chesterfield Home:

~ Better finished basement with a large family room with wet-bar plus a huge guest bedroom and full bath (the other house has a nicely finished family room but it doesn’t have the bedroom/bathroom)

~ Since the house doesn’t have a laundry room upstairs, the breakfast room is much bigger

~ The front of the house has a covered front porch and slightly better curb appeal (this one is more personal preference but Mr. Buyer didn’t care for the painted brick on the other house)

~ Cul de sac lot (the other house is on a quiet street but is not on a cul de sac)

~ The upstairs bathrooms are slightly better (but most people seeing just the other house would think they were really nice and have no complaints)

Oh, and the price on the Chesterfield house is $10,000 lower…and we are already a little above the price my clients wanted to spend.

Keep in mind that if my clients had seen just one of the homes, I think that they would have been happy with either one. But since they were so similar and each had pros & cons, the decision was a struggle. At the end of the day, we decided that I would do some research on the pricing and appreciation rates on the 2 subdivisions, and we would go back and see them again the next day along with seeing 2 more homes that were both long shots that they hadn’t seen yet.

Subdivision pricing research painted a clear difference between the two subdivisions:

At the end of the first day, they had been leaning a little more towards the more expensive Ballwin home due to the yard and laundry room.

However, my review of the homes sales over the last year showed that the vast majority of the homes in this Ballwin subdivision had sold for about 20% less than the home my clients liked. One of the reasons for the difference is that the vast majority of homes in this subdivision are ranches, and the rehab is one of only a few 2 stories that have sold recently. Plus, rehabs almost always sell at the upper end of the comps…as they should. Unless there is a problem with lot location or something like power lines behind the house, a house that has been completely updated should sell for more than the other homes that haven’t been completely redone.

BUT, buying the most expensive home in the subdivision is risky.

For one thing, if you have one of the only rehabs in the subdivision and 5 years later you go to sell, there is a good chance that when you sell all of the recent comps will be non-rehabbed homes. You will likely be priced dramatically over the rest of the homes and will look overpriced since very few other agents apply subdivision appreciation rates to the prior purchase price as a factor in determining value. In addition, when a home has been priced as a total rehab, it leaves very little room for you to get any money back if you decide to add a few more upgrades yourself.

So, what about the other home?

The Chesterfield house had a couple of drawbacks (mostly the totally wooded yard that dropped straight off at the back of the house and the basement laundry). But, the price is lower and the subdivision is a better investment.

Not surprisingly, this home is also priced at top-dollar for the subdivision given that it is a rehab. But, this subdivision has a much higher percentage of 2 stories, so the rehab will never be sold at a time when it is being compared to a sea of ranch comps. In addition, the 2 stories that were not rehabbed and had sold recently were selling for about 10% lower than this house. I’m much more comfortable with the $30,000 difference between the rehabbed homes & the list price of the rehab than the $60,000 difference of the typical home sale in the other subdivision.

Still, they would be buying one of the most expensive homes in the subdivision since it was the biggest floor plan and completely updated.

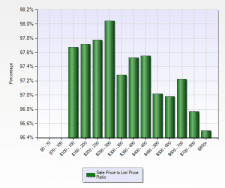

(BTW, my Precise Pricing subdivision appreciation rate analysis showed that both subdivisions have a current annual appreciation rate of 4.1%)

So what did my buyers decide to do?

Remember I said that we were going to look at two other homes that were longshots. One of them was priced even slightly higher than both of these homes, and my buyers REALLY didn’t want to spend that much. (BTW…I never show homes above my buyers’ upper price limit unless they ask to seem them!)

They liked the most expensive home best. This one was in a much nicer subdivision. The house wasn’t rehabbed, but it was certainly a house that they could move into and be comfortable. The basement wasn’t finished, but it’s just the two of them now, so they don’t really need the space. This house is priced at the low end of the recent homes sales, so there is much more room for my buyers to make improvements and get their money back when they sell.

They really had a dilemma. It was clear to all of us that the 3rd subdivision was a much better investment, but it was more money than they were comfortable spending. The made the hard decision to walk away from all three homes.

Next weekend they’ll be back in town and we are going to look in St. Charles where they can spend less. They won’t get their dream home in the part of town that they really wanted to live, but they are making a wise decision. I wish more buyers realized that buying a home isn’t just about where you will live, but it is also a big investment. Since they only plan to live in this house for around 5 years, they are making the smart choice to make compromises now, so they can have a better future later.

Kudos to them for being smart with their money.